Which Best Describes the Difference Between Stocks and Bonds

Best describes the difference between stocks and bonds does motley fool have funds or etfs. Bonds are loans to the.

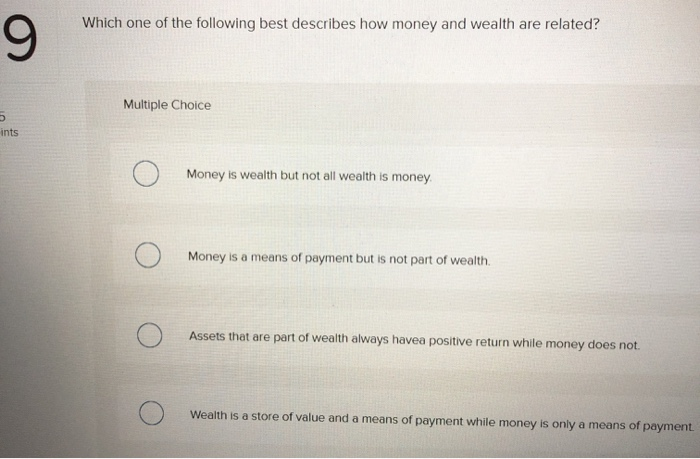

Solved After Reading The Descriptions To The Right Please Chegg Com

1596 students attemted this question.

. Stocks pay interest to investors throughout the year. Convertible bonds warrants and other exotic bond features As the name suggests convertible bonds allow the owner the option to convert the bonds into a fixed. While bonds are issued by all types of entities including governments corporations nonprofit.

With stocks investors own a fraction of the company whereas bonds are taken as loans investors give to a company or organization. Learn why that matters as you make investments. Therefore the main difference between bonds and stocks.

Stocks are a riskier investment than bonds Bonds offer a higher repayment priority than stocks making them a riskier investment. Which best describes the difference between stocks and. Which best describes the difference between stocks and bonds.

To raise money to grow the company. Diversified mutual fund Treasury bond Stock. Stocks give you partial ownership in a corporation while bonds are a loan from you to a company or government.

In contrast bondholders may be given a much higher priority. - Stock allow investors to share in profits. Bonds make investors responsible for company debts.

Which best describes the difference between stocks and bonds everfi. Bonds only pay interest at fixed times during the yearHope this help. What is the primary reason to issue stock.

Find step-by-step Economics solutions and your answer to the following textbook question. The critical difference between stocks and bonds is that one is an ownership stake and the other is debt. If youre interested in a U.

A Stocks allow investors to share. Because stocks are more volatile social trading malaysia pot stocks. Among the choices the one that best describes the difference between stocks and bonds is B stocks allow investors to own a portion of the company.

The biggest difference between them is how they generate profit. Stocks are equity instruments and can be considered as taking ownership of a company.

Solved After Reading The Descriptions To The Right Please Chegg Com

Modern Portfolio Theory Markowitz Portfolio Selection Model Modern Portfolio Theory Investing Economics Definition

Solved Stocks And Bonds That Are Held As Wealth Fulfill Chegg Com

Solved Which Of The Following Features Best Defines A Chegg Com

Chart The Downward Spiral In Interest Rates During The Onset Of An Economic Crisis National Governments Interest Rate Chart Interest Rates Financial Wealth

Solved After Reading The Descriptions To The Right Please Chegg Com

Solved Reading The Descriptions To The Right Please Place Chegg Com

10 Best Personal Finance Books Of All Time Personal Finance Books Finance Books Personal Finance

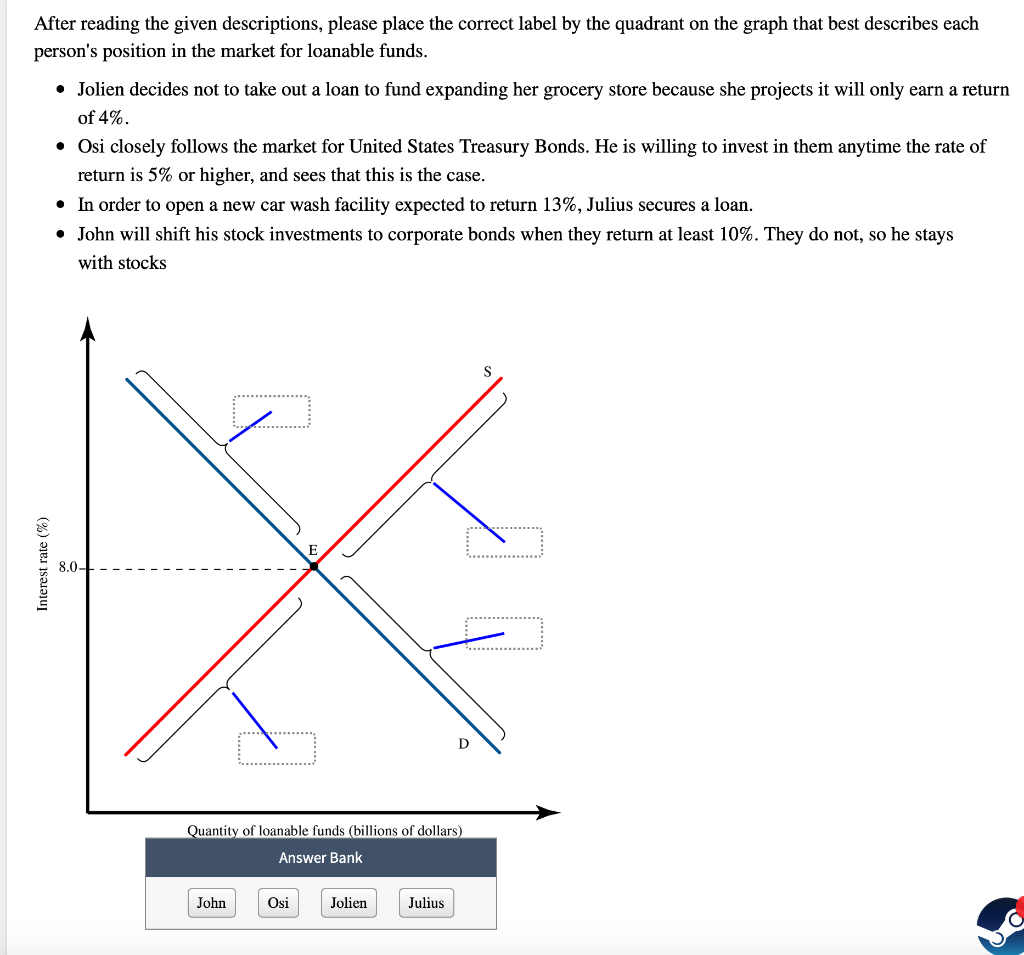

Solved After Reading The Given Descriptions Please Place Chegg Com

The Best Lazy Portfolios For Wealth Building Investing Mutual Funds Investing Basic Investing

Solved Ruiz Instructions Question 1 2 5 Pts Which Of The Chegg Com

17 Proven Ways To Get Free Money Fast Now Up To 100 Day Stock Market For Beginners Stock Market Investing

Solved After Reading The Given Descriptions Please Place Chegg Com

What Is High Low Bands Indicator How To Plot It In Zerodha Kite Or Other Charts This Post Describes How To Trade Using High Low Bands Low Band High Low

Financial Literacy Education Learn Finance Finance Investing Finance Investing

:max_bytes(150000):strip_icc()/dotdash_Final_Bond_Apr_2020-01-8b83e6be5db3474e896a93c1c1a9f169.jpg)

Comments

Post a Comment